Islamic Banking in Treasury: A Practical Case from Kazakhstan

How can Islamic financial instruments be integrated into a bank’s day-to-day treasury operations while remaining competitive in the market? Aydyn Tairov, an expert in Islamic banking, shares hands-on experience in implementing Shariah-compliant products within treasury practice — from Murabaha and Ijara to Sukuk and investment deposits.

Core Principles of Islamic Banking

Islamic banking is built on several mandatory principles.

First, money is not considered a commodity. It is a medium of exchange and a unit of account, but not an asset that can generate income on its own through interest. As a result, transactions where the bank’s income is derived purely from charging interest are prohibited.

Second, there are strict limitations on uncertainty and speculation. Products cannot be structured in a way where outcomes depend primarily on chance or price gambling. In Islamic terminology, this is the prohibition of gharar and maysir. In practice, it means that contract terms must be clear to the client and all calculations transparent.

Third, certain types of activities are prohibited. Islamic financial institutions do not finance or insure businesses related to alcohol, tobacco, weapons, gambling, and other industries explicitly forbidden under Shariah.

The permitted toolkit includes cost-plus trading, leasing, profit-and-loss-sharing partnerships, mutual insurance, investment certificates (Sukuk), and agency-based asset management models. All these products are anchored in real assets or projects, rather than the trading of debt.

For banks, this implies stricter discipline: before entering a transaction, not only collateral but also the underlying project economics must be assessed. For treasury functions, this is equally critical—liquidity cannot simply be parked in an interest-bearing instrument; it must be deployed through structures that generate returns while complying with Shariah principles.

International Institutions and Methodology

Islamic banking is not based on fragmented local practices but on a well-established international framework. Kazakhstan is integrating into an existing global system rather than building Islamic banking from scratch.

On the regulatory side, the Islamic Financial Services Board (IFSB) plays a role similar to the Basel Committee. It issues standards on capital adequacy, risk management, corporate governance, and supervision for Islamic financial institutions. Regulators rely on these standards when designing rules for fully fledged Islamic banks as well as Islamic banking windows operated by conventional banks.

Accounting and audit standards are set by AAOIFI, which develops specific guidance for Islamic financial institutions. This enables consistent and comparable reporting for Murabaha, Ijara, Sukuk, and other Shariah-compliant products.

At the market-development level, the Islamic Development Bank Group supports project financing and investment under Islamic principles, including through subsidiaries focused on the private sector and financial institutions.

Corporate Financing Structures

On the corporate side, an Islamic bank addresses the same objectives as a conventional bank: financing fixed assets, new projects, and working capital. The difference lies in the contractual form.

Ijara.

Islamic leasing. The bank purchases an asset from a supplier, becomes its owner, and leases it to the client. The client makes lease payments, and upon maturity—subject to agreed conditions—the asset is transferred to the client via sale or gift. The bank’s income comes from rental payments, not loan interest.

Murabaha.

Used to finance a specific purchase. The client obtains a quotation from a supplier and approaches the bank. The bank agrees on parameters, purchases the asset, and resells it to the client at a disclosed markup with deferred payment. Legally, this involves two sales transactions; economically, it is financing at a known total cost.

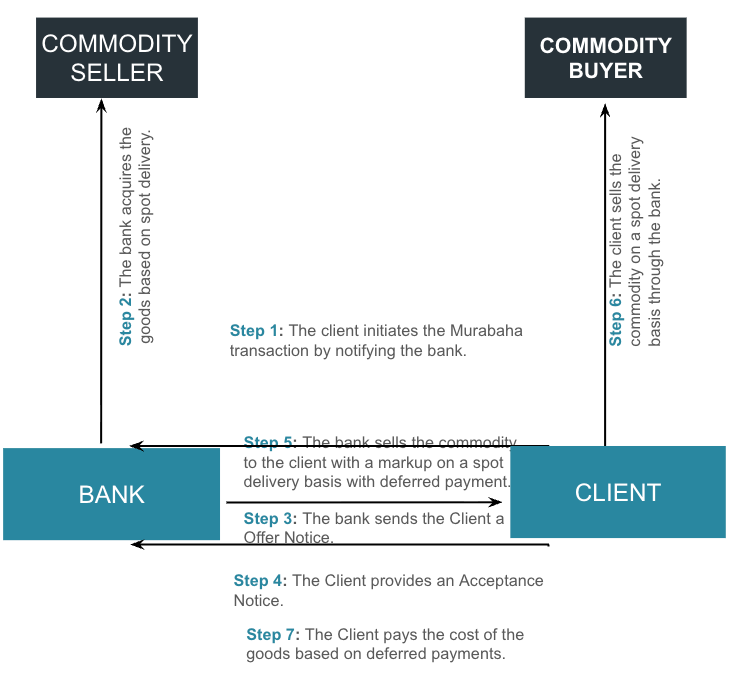

Commodity Murabaha (Tawarruq).

Applied when the client needs liquidity rather than a specific asset. The bank purchases a commodity (typically exchange-traded metals), sells it to the client with a markup and deferred payment, and the client immediately sells it on the spot market to a third party. Cash flows to the client, while the obligation to repay the marked-up price remains. This structure finances working capital through a chain of Shariah-compliant trade transactions.

Core Treasury Instruments in Islamic Banking

Islamic treasury operations rely on a limited but flexible set of instruments: Murabaha, Wakalah, Mudarabah, Sukuk, and commodity Murabaha. These serve as building blocks for treasury structures.

Murabaha establishes the cost-plus trading model and is used both in corporate financing and interbank transactions, where liquidity transfer is structured through deferred commodity sales.

Wakalah and Mudarabah are capital-management structures. The bank acts as manager, while the client is the investor; profits are shared according to agreed ratios. For treasury, these structures are a way to attract and structure funding for investment assets, including Islamic securities.

Sukuk are the primary market instrument for deploying funds. Investor rights are linked to underlying assets or projects, and returns depend on asset performance rather than interest on debt.

Commodity Murabaha is also used in interbank and even central-bank-style liquidity operations. Liquidity is redistributed through commodity trades, which remain formally Shariah-compliant sales transactions.

While this architecture may appear more complex than classic overnight deposits and loans, it provides flexibility: structures can be tailored by tenor, currency, funding source, and Shariah constraints

Liquidity Management

In terms of objectives, liquidity management in an Islamic bank closely mirrors that of a conventional bank: regulatory compliance, maturity gap management, and yield optimization. The difference lies in the instruments.

The primary working tool is interbank commodity Murabaha. When one bank needs liquidity and another has excess funds, the transaction is structured as a series of commodity trades. The liquidity-rich bank purchases a commodity and sells it to the counterparty at a markup with deferred payment; the counterparty sells the commodity on the spot market to obtain cash. One bank places funds with a return, the other raises liquidity—while the transaction remains Shariah-compliant.

Additional placements use Wadi’ah and Mudarabah structures.

Wadi’ah accounts are safekeeping deposits with guaranteed principal and no fixed return.

Mudarabah placements involve profit-sharing, with clients participating in the performance of an asset pool managed by the bank.

The third pillar is Islamic securities—notes, lease certificates, and Sukuk—which form the liquid, marketable portion of the balance sheet and function similarly to a bond portfolio, albeit in Islamic legal form.

In practice, liquidity management is a constant balance between Shariah compliance, regulatory requirements, and competitive returns for clients and shareholders.

Investment Instruments

Beyond daily liquidity, the investment portfolio typically focuses on three areas: Sukuk, Islamic money market funds, and Mudarabah/Wakalah pools.

Sukuk form the backbone of the portfolio, encompassing both sovereign and corporate issuances. Each Sukuk is linked to specific assets or projects—real estate, infrastructure, manufacturing—which directly affects risk assessment and diversification strategies.

Islamic money market funds provide short-term placements with relatively quick liquidity. They invest in a range of Shariah-compliant money market instruments, offering portfolio flexibility.

Mudarabah and Wakalah pools combine funds from clients and the bank. The bank acts as manager, while investors share profits and risks. For treasury, these pools represent a structured source of long-term funding tied to real assets and projects.

Foreign Exchange Risk Management

FX risk does not disappear in Islamic banking, but conventional derivatives cannot always be used in their standard form. Structures must allow risk mitigation without violating prohibitions on interest and excessive uncertainty.

The primary tool is FX swaps structured around wa’ad (unilateral promises). Economically, the structure replicates a swap, while legally it relies on binding promises and subsequent transactions rather than direct interest-based cash-flow exchanges.

A second category includes commodity-based forwards. Hedging is achieved through asset trades that fix prices and exchange rates via purchase and sale transactions, rather than through pure currency forwards.

Additional structures based on dual Wakalah and unilateral wa’ad provide further flexibility in allocating risks and returns between counterparties.

Investment Deposits

Investment deposits clearly illustrate the difference between Islamic and conventional banking. A conventional deposit is a loan to the bank with a fixed interest rate. In the Islamic model, the client participates in investments, sharing profits and risks.

Under Wakalah deposits, the client acts as investor and appoints the bank as agent to manage funds within Shariah limits. Assets and projects are selected accordingly, and profits are shared based on pre-agreed ratios. A master agreement is signed first, followed by individual terms, fund placement, and final profit distribution.

Restricted Wakalah imposes a narrower mandate: permitted sectors, instrument types, and sometimes specific projects are defined in advance. Investments are linked to designated assets or pools. While early exit flexibility is lower, clients knowingly accept targeted risks in exchange for potentially higher returns.

For treasury, these deposits represent a stable funding base linked to real economic activity rather than abstract interest rates. For clients, they are not merely deposits but participations in Shariah-compliant investments. The bank’s task is to ensure transparency, accurate risk assessment, and full compliance with both Shariah standards and regulatory requirements.

Conclusion

Islamic banking in treasury is not a separate religious financial universe, but an alternative way of addressing familiar banking tasks: corporate financing, liquidity management, investments, and FX risk. Instead of interest and conventional derivatives, it relies on trade, leasing, partnerships, and agency models, with every transaction anchored to a real asset or project and subject to Shariah review.

For banks considering Islamic products or Islamic windows, the takeaway is straightforward: the infrastructure already exists—international standards, proven transaction structures, and market practice. The real question is whether management and treasury teams are prepared to accept additional structural constraints and discipline in exchange for access to a new market segment and more resilient, real-economy-linked financing models.

Anti-Fraud: Fraudsters Shall Not Pass. But What About Customers?

How can companies fight fraud without killing conversion and sales? An industry expert shares hands-on experience—from basic rules to advanced models, from manual checks to resilient anti-fraud systems that not only reduce risk but actively improve customer experience and revenue.

When the problem isn’t rates, but dates: where banks quietly lose money

Treasury. Interest rate risk (IRR). FTP. BP01. NII and NIM. Cost of Funds (CoF). Refixing risk (rate reset dates). P/L and Risk Limits. Swaps and shift fixings. Balance sheet management.